If you’re running a business in Canada, there’s a good chance you’re dealing with GST or HST. It sounds dull, but getting your tax return right means fewer worries down the road—and possibly even a refund.

Don’t worry, it’s not as scary as it sounds. With the right info and a bit of prep, filing your GST/HST return online can be pretty straightforward.

Let’s walk through it together.

First Things First: Know What You’re Filing

GST (Goods and Services Tax) and HST (Harmonised Sales Tax) are collected on most sales in Canada. If you’re registered for GST/HST, the Canada Revenue Agency (CRA) expects a return—even if you didn’t collect any tax that period.

You can file monthly, quarterly, or annually, depending on your setup. Miss a deadline, and you could face penalties. So, set reminders and don’t leave it till the last minute.

Step 1: Keep Your Records Clean

Before filing anything, your records need to be sorted.

You’ll need to know:

- How much GST/HST you collected on your sales

- How much GST/HST you paid on business expenses (these are your Input Tax Credits, or ITCs)

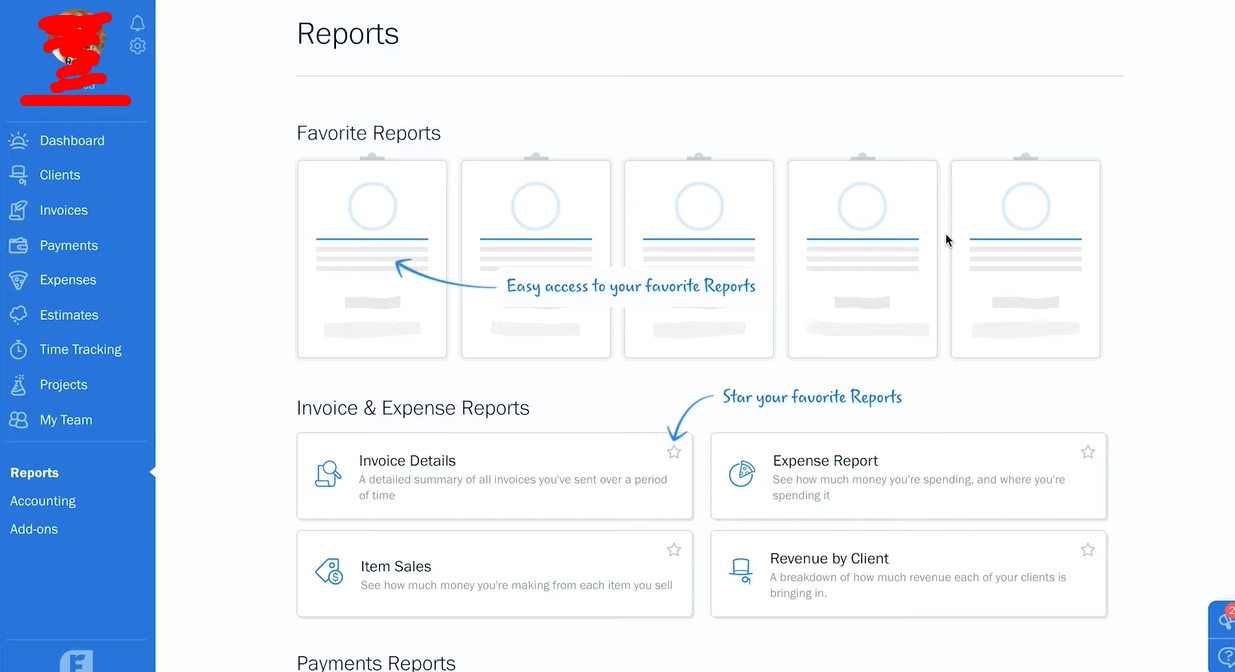

If you’re using software like FreshBooks or QuickBooks, most of this will be organised already. If you’re still using spreadsheets, no worries—just double-check that every sale and expense is listed clearly with dates, amounts, and the GST/HST included.

Pro tip: Use software if you can. It saves time, catches errors, and makes this whole process much easier.

Step 2: Calculate Your Net Tax

The basic idea is simple:

GST/HST collected – GST/HST paid on eligible expenses = Net Tax

If the number is positive, you owe that amount to the CRA.

If it’s negative, you may get a refund.

Make sure your ITCs are legit. Things like office supplies, accounting fees, and eligible travel costs usually count. But personal expenses? Not so much.

Step 3: Use the CRA’s GST/HST Working Copy (Optional but Handy)

The CRA offers a printable GST/HST Working Copy PDF. It’s not required, but it helps you stay organised before jumping into the online system.

Here’s what you’ll fill in:

- Line 101: Total sales, no tax included

- Line 103: GST/HST collected

- Line 105: Total tax collected (plus any adjustments)

- Line 106: Tax paid on expenses (your ITCs)

- Line 108: Total credits you’re claiming

- Line 109: Final net tax (line 105 minus line 108)

This working copy is your cheat sheet. When it’s time to file online, you won’t be scrambling for numbers.

Step 4: Log In to My Business Account

Head to the CRA’s website and log in to My Business Account. If you haven’t registered yet, it only takes a few steps—but do it early so you’re not rushing later.

Once you’re in:

- Go to GST/HST and choose “File a Return”

- Select the correct reporting period (monthly, quarterly, or annual)

- Double-check the dates

Even if your business didn’t collect or pay GST/HST during the period, you still need to file a nil return. Don’t skip it.

Step 5: Enter Your Numbers

Take the figures from your software or working copy and enter them into the CRA form:

- Revenue without tax

- GST/HST collected

- ITCs you’re claiming

- Any adjustments (if needed)

The system will auto-calculate the net tax. Review everything carefully. Typos here can cause real headaches later.

Step 6: Submit and Save the Confirmation

After reviewing the summary page, hit Submit.

You’ll get a confirmation number from the CRA. Save it. Screenshot it. Tattoo it (okay, maybe not). But don’t lose it—it’s proof you filed.

Step 7: Make a Payment (If Needed)

If your return shows you owe money, it’s time to pay the CRA. Here’s how:

- Online banking (just like paying a bill)

- Credit card or PayPal (via third-party services)

- Wire transfer (for international businesses)

Important: If you owe $50,000 or more, you must pay electronically. No cheques. No excuses.

Final Tip: Don’t Let It Pile Up

Filing GST/HST returns is much easier when you stay on top of your bookkeeping. Waiting till the end of the quarter—or year—to sort it all out is asking for trouble.

If you’re feeling overwhelmed, consider getting help from an accountant. Or at least use accounting software to keep things tidy.

Summary

Filing your GST/HST return online doesn’t have to be a nightmare. Just keep your records in check, crunch the right numbers, and use CRA’s tools to guide you.

And remember—don’t skip it, even if there’s nothing to report.

Need help staying compliant without the stress? Talk to an accountant who knows their way around the CRA system. Sometimes a little support can save a lot of time.